Insurance for House Cleaners: What You Need to Know

Running a house cleaning business involves many moving parts—booking clients, managing staff, and ensuring quality service. Yet, one critical area often overlooked is securing the right insurance for house cleaners. From protecting your equipment to covering potential liabilities, proper insurance safeguards your livelihood and builds trust with clients.

Whether you’re a solo cleaner or manage a growing team, understanding insurance basics can help you navigate the complexities of coverage, reduce financial risks, and enhance your professional image. This article delves into essential policies, how to select the right provider, and strategies for integrating insurance into your overall business plan.

Why Insurance Matters for House Cleaners

House cleaning professionals operate in an environment where accidents can happen—spilled cleaning solutions, damaged valuables, or even injuries on the job. Without the right insurance, these incidents can lead to significant financial setbacks and reputational harm.

Key Benefits of Having the Right Insurance for House Cleaners:

- Financial Protection: Safeguard your business from costly lawsuits, property damage claims, or medical expenses.

- Professional Credibility: Show clients that you take your responsibilities seriously, inspiring trust and repeat business.

- Peace of Mind: Focus on delivering exceptional cleaning services without constantly worrying about “what if” scenarios.

For broader strategies on growing a stable, reputable cleaning business, consider exploring our house cleaning business consulting services.

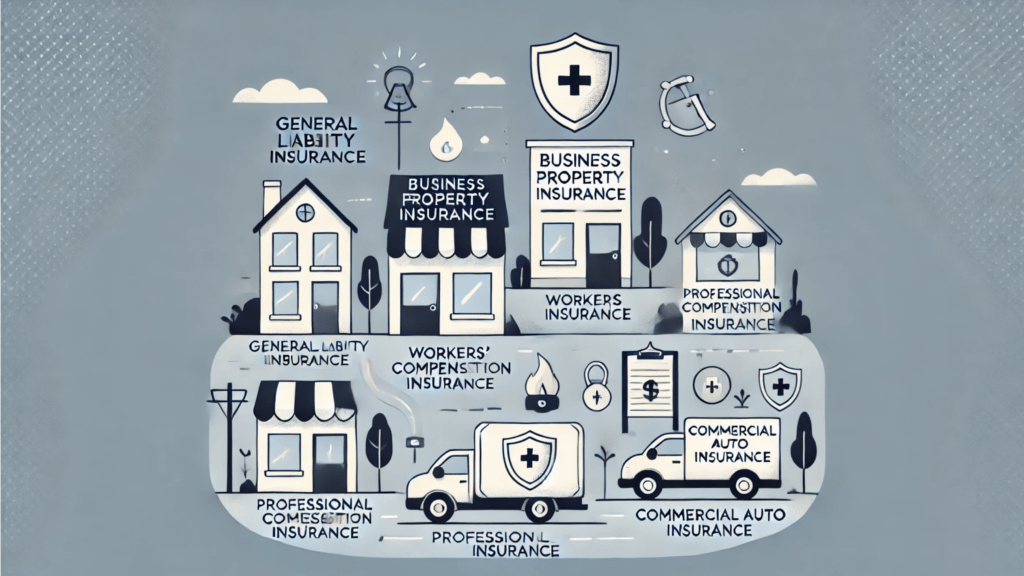

Types of Insurance Policies to Consider

1. General Liability Insurance for House Cleaners

What It Covers: Third-party bodily injury, property damage, and legal costs if someone files a claim against your business.

Why It’s Important: Even careful cleaners can accidentally break a client’s vase or cause a slip-and-fall incident. General liability insurance cushions the financial blow and helps maintain your professional reputation.

2. Business Property Insurance

What It Covers: Damage or loss of equipment, cleaning supplies, and other business property caused by theft, fire, or certain accidents.

Why It’s Important: House cleaners rely on tools and supplies to get the job done. Replacing these items out-of-pocket can be expensive. Insuring your assets ensures minimal disruption to your operations.

3. Workers’ Compensation Insurance

What It Covers: Medical expenses, lost wages, and rehabilitation costs if an employee is injured on the job.

Why It’s Important: If you have staff members, workers’ comp is often legally required. It protects both your employees and your business, ensuring that workplace injuries don’t lead to costly legal disputes.

4. Professional Liability Insurance for House Cleaners

What It Covers: Claims related to unsatisfactory work, negligence, or professional errors.

Why It’s Important: If a client alleges that you or your team performed subpar cleaning services resulting in health issues or damage, professional liability coverage protects you from litigation expenses.

5. Commercial Auto Insurance

What It Covers: Accidents, property damage, and bodily injury involving company vehicles.

Why It’s Important: If you use a vehicle to transport cleaning supplies or move between client locations, insuring it avoids potentially steep repair or medical bills due to an accident.

Comparison Table: Common Insurance Policies for House Cleaners

| Policy Type | Coverage Highlights | Ideal For |

|---|---|---|

| General Liability | Bodily injury, property damage | All house cleaning businesses |

| Business Property | Equipment, supplies, inventory loss | Businesses with valuable assets |

| Workers’ Compensation | Employee injuries, lost wages | Companies with hired staff |

| Professional Liability | Claims of negligence, poor service | Businesses offering specialized tasks |

| Commercial Auto | Vehicle accidents, damage, liability | Businesses using company vehicles |

How to Choose the Right Insurance Provider

Considerations When Selecting Coverage

- Assess Your Risks: Identify common hazards—e.g., working with fragile décor, cleaning high-traffic areas—to determine necessary coverage.

- Compare Quotes: Obtain multiple insurance quotes to find competitive rates and comprehensive coverage options.

- Check Reputation: Look for providers with strong financial ratings, responsive customer service, and a track record in your industry.

- Review Policy Terms: Understand exclusions, deductibles, and coverage limits before finalizing your choice.

For guidance on strengthening your overall business model and improving client relationships, consider our business consulting services and see how other entrepreneurs have grown their enterprises in our testimonials.

Tips for Integrating Insurance into Your Business Strategy

- Highlight Your Coverage: Mention your insured status in marketing materials, proposals, and your website. Clients value the added security.

- Bundle Policies for Discounts: Consider purchasing multiple policies (like general liability and property insurance) from the same provider for cost savings.

- Review Annually: As your business grows or changes focus, reassess your insurance needs. Add or adjust coverage to match your evolving risk profile.

For more ways to enhance your business reach, explore our content on upselling and cross-selling techniques and learn how to attract local clients through local SEO strategies.

Steps to Get Insured Quickly

- Evaluate Your Needs: Determine which policies are most relevant.

- Gather Information: Have details about your business structure, annual revenue, and number of employees ready.

- Request Quotes: Contact several insurers for cost estimates.

- Compare and Negotiate: Review coverage and price. Consider negotiating for better terms.

- Purchase and Implement: Once satisfied, buy your policy and store documentation in a safe place.

FAQ

How Much Does Insurance for House Cleaners Cost?

Costs vary based on factors like location, number of employees, and the scope of services. A small operation might pay a few hundred dollars annually for basic coverage, while larger companies with more risk exposure could invest thousands.

Is Insurance Legally Required for a House Cleaning Business?

Requirements differ by location and business size. While general liability insurance isn’t always mandated, workers’ compensation is often required if you have employees. Always check local regulations to ensure compliance.

Does Insurance Cover Damage to a Client’s Property?

General liability policies typically cover accidental damage to a client’s possessions. However, review your policy details for any exclusions or coverage limits.

Can I Change My Policy As My Business Grows?

Yes. Insurance policies can be adjusted as you add services, hire employees, or expand your service area. Regularly reviewing coverage ensures it stays aligned with your current risk profile.

Protecting your cleaning business is more than a smart investment—it’s a necessity. Contact Us Today to learn how our consulting services can help you optimize your operations, better understand insurance needs, and position your company for lasting success.